Personal Banking for Farmers and Small Businesses in Rural Nigeria.

Personal Banking for Farmers and Small Businesses in Rural Nigeria.

Role

Product Designer

Industry

Financial Technology

Duration

Q4 2023 - Q2 2024

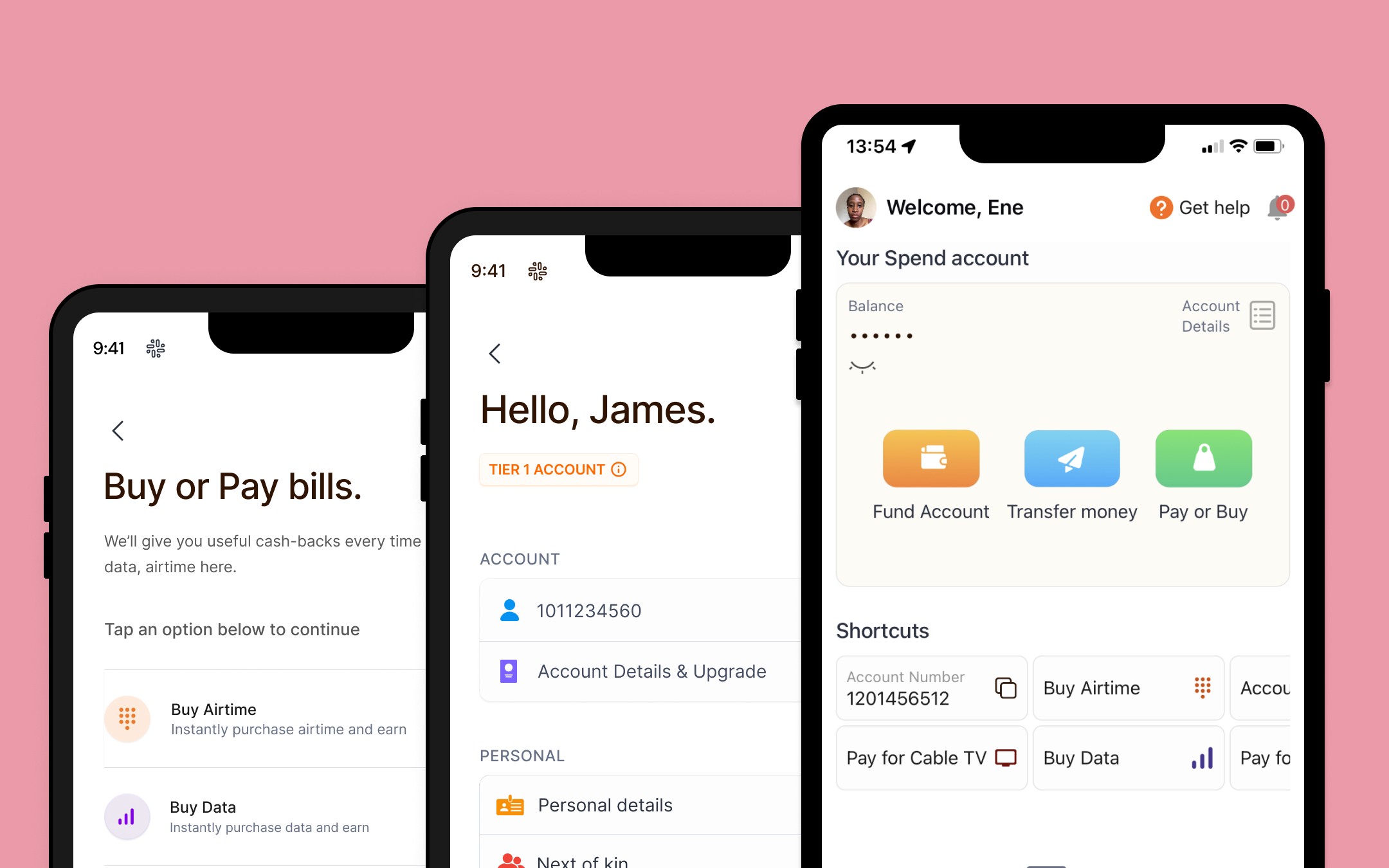

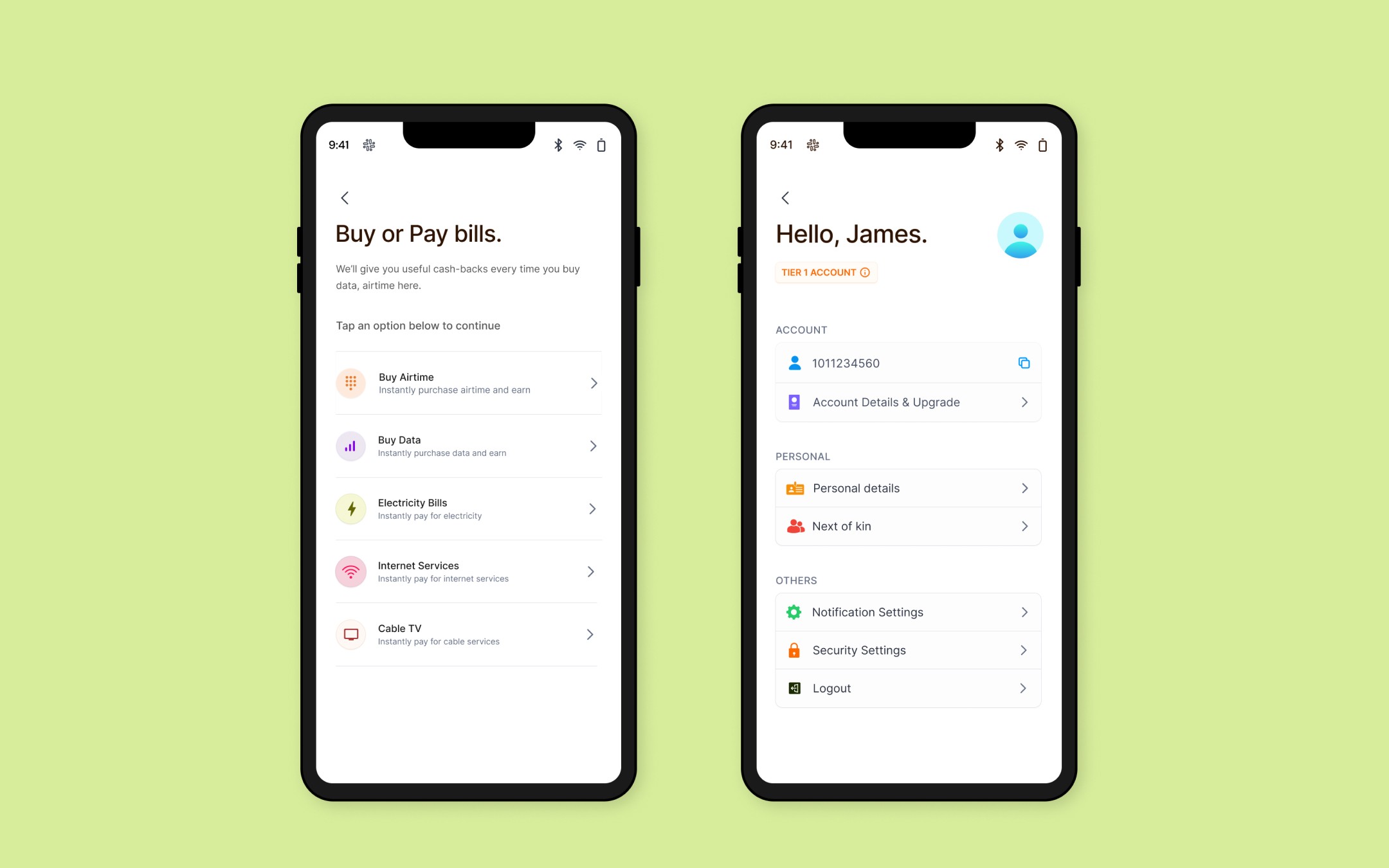

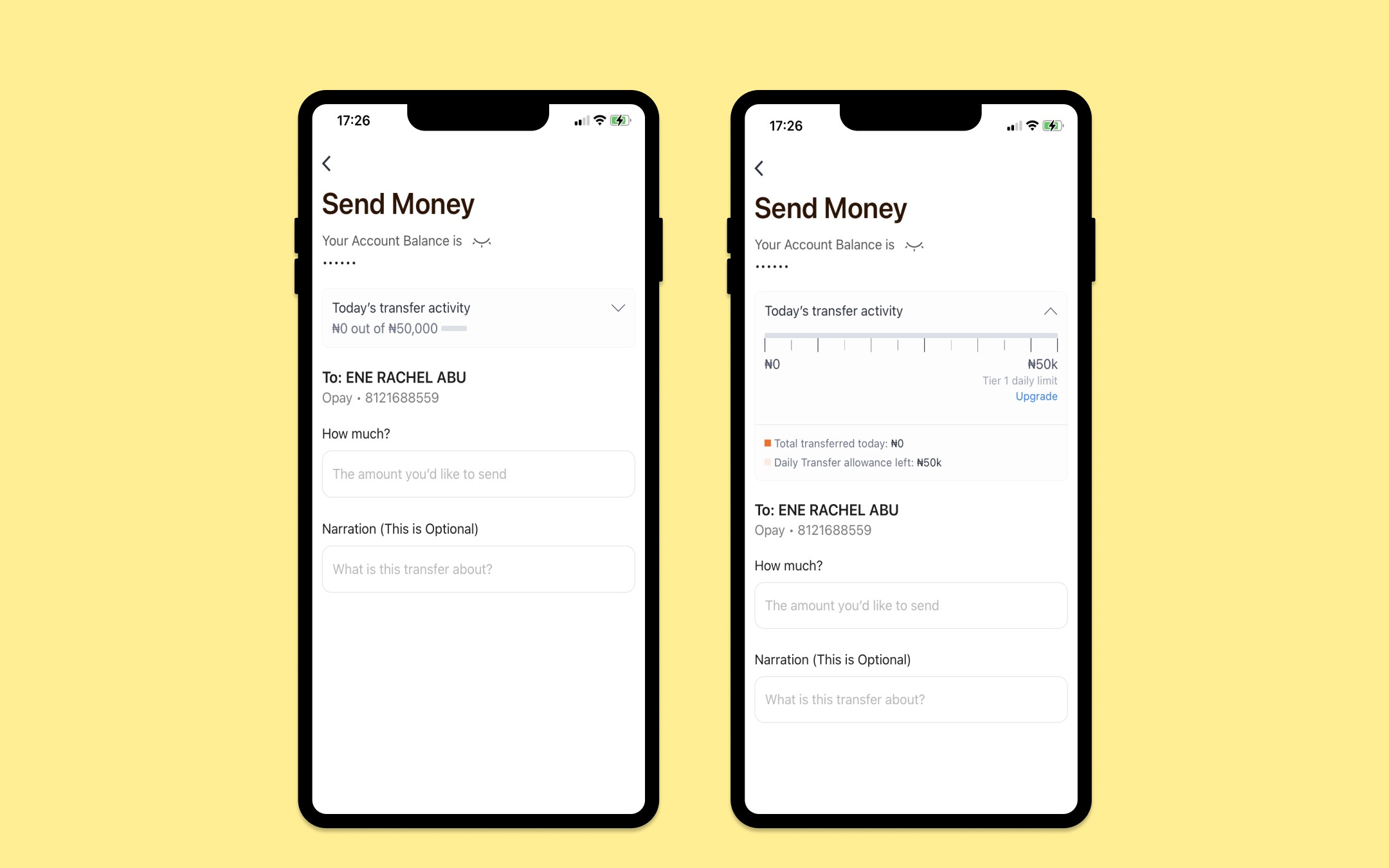

Navigating the User's Path

When determining what a user would be required to do to be onboarded to the app, user flows assisted the team in having a bird’s eye view of what onboarding would look like and what we were asking users to provide to create an account successfully. It also enabled engineers to identify technical constraints early on and suggest feasible alternatives. For a user to be successfully onboarded into the app they had to complete the following steps:

Phone number verification. A One-time password is sent to the phone number they provide.

Create a Login passcode. A secure passcode is required for account access.

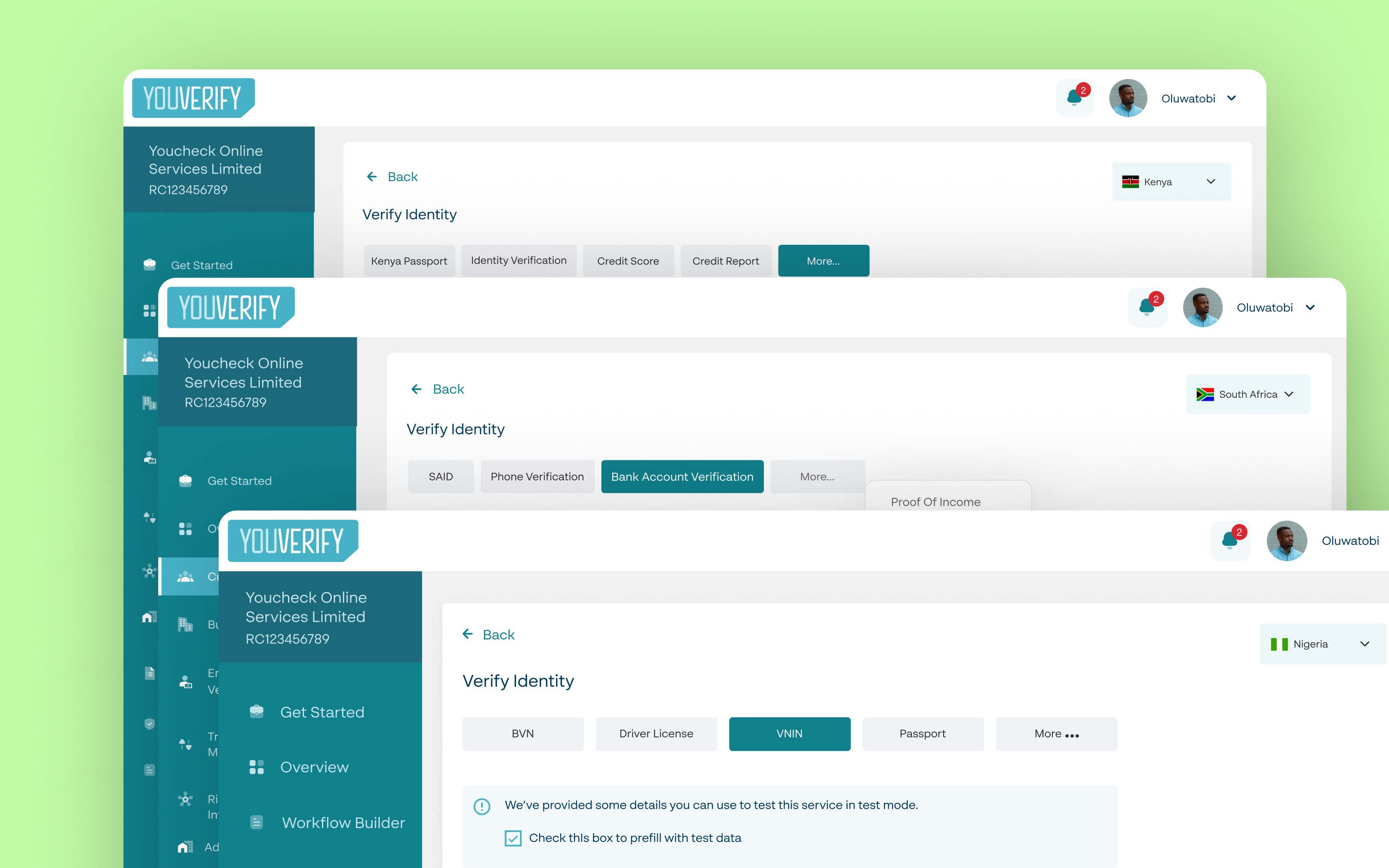

Bank verification number (BVN) verification. A unique number for the Nigerian bank account holder is verified.

Liveness check. A facial comparison is conducted between the BVN image and a live captured image.

Place of birth. Users provide details of where they were born as part of KYC requirements.

Provide residential address. Basic information about where they lived is collected.

Create a Transaction PIN. A 6-digit PIN is required for all transactions.

Enable biometrics on their devices. Users are prompted to enable fingerprint or facial recognition for enhanced security.

The challenge in creating the onboarding flow was deciding what comes first and why. The steps are divided into verification and personalization steps, we arranged the steps in no particular order but 3 steps had to be positioned intentionally.

Phone number verification had to come first. We needed to validate that the phone number provided belonged to a real person and this required instant verification through a one-time passcode sent as an sms to the same phone number.

BVN verification had to come before the Liveness check. The image attached to a person’s BVN would be used for a facial comparison with the image obtained from the liveness check.

User flows were crucial for the team. Similar to the onboarding flow, they allowed us to map out how users could complete various tasks on the app before diving into design.